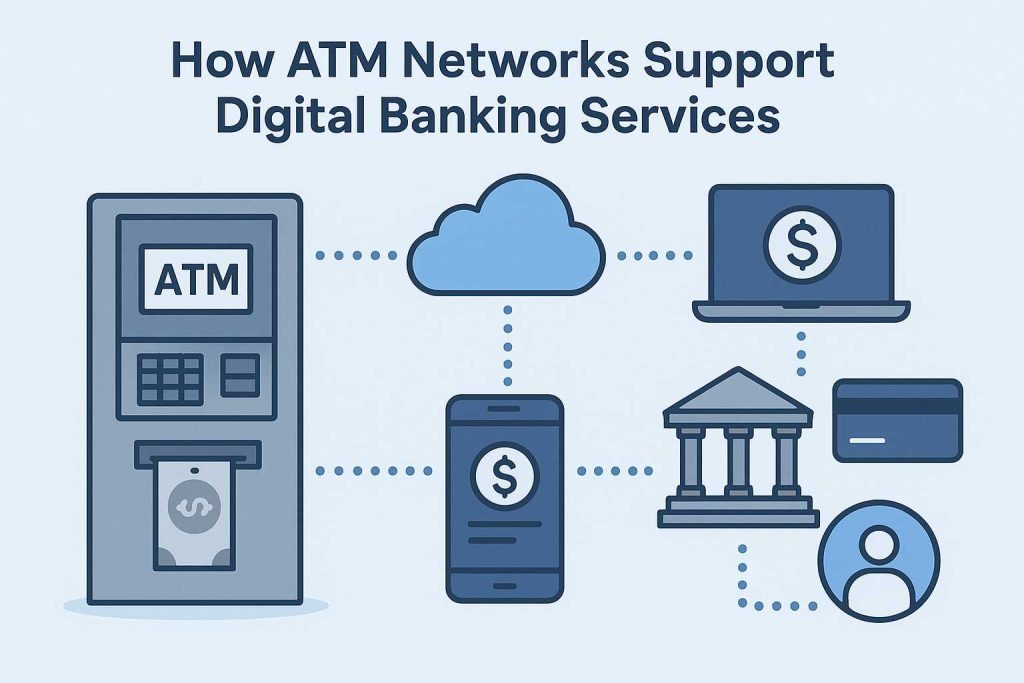

The variance in the technological advancements in the financial world has taken it from ATM Machines or Automated Teller Machines. Precisely, to the CPT or Contactless Payments Technology. This is the prestigious era of mobile banking & self-service banking & we might be part of a new technological innovation in a matter of just one day.

ATM MACHINES Vs CPT:

As a matter of fact it’s the compare & contrast world & some people wants to know precisely what’s best, i.e. ATM machines as compared with CPT or Contactless Payments Technology.

The Contactless Payments Technology is far faster than using an Automated Teller Machine. So, in a single way we have actually got the advantage of CPT or Contactless Payments Technology. Obviously, you just need to put your card on the POS terminal. Otherwise, give it to the customer service rep, who will do that for you. Later, the terminal will generate a receipt which makes sure that your payment has successfully gone through.

Atm machines are cash dispensers as for those people who need the peace of mind, they are a huge source of ease being vital cash dispensers.

A SCENARIO WHICH PROVES CPT IS NOT SO FAMOUS:

Lets discuss a scenario that falls here against use of CPT or Contactless Payments Technology. I remember the other day while I was shopping with my granddad in a mobile shop. Me and my grandfather purchased a mobile which he actually was gifting to me as my birthday present. My grandfather urged me to pop-in an ATM machine, so that he take out the necessary cash to pay off.

However, I insisted that as we are getting late, we just need to be in a queue of two people & we can pay by card. That is, via CPT or Contactless Payments Technology. He then said to me. I don’t want my Pin# to be seen by the customer service rep. I told him, that won’t happen as you just need to put the card on the payments terminal & your payment will be qualified as successful.

Also Read: Is ATM Machine Business Profitable In Canada

However, upon my insisting my granddad put the card on the POS terminal. As he was convinced when I showed him the ‘Contactless sign’ on the Visa card. Contactless Payments Technology or CPT Payments is what the card be utilised for, as it shows. He was amazed to see the receipt coming out of the machine which meant the payment was taken successfully. However, being an old man, & not very much acquainted with technology, he still said, I am not feeling the ‘peace of mind’. I would rather prefer paying by cash even if it results in some extra 10-15 mins.

PEACE OF MIND IS A FACTOR THAT IS ALWAYS A PLUS FOR AGED CUSTOMERS:

Thus, I came to a conclusion that it’s the ‘Peace of mind’, which is a huge factor & has no other alternative. Especially, for the people who are a bit old & doesn’t believe in CPT or Contactless payments Technology. They might even believe, but as part of the preferences they rely more heavily on the ‘Peace of Mind’ factor.

Bank machines or ATM Machines & many other ATM Services are the older ones than CPT or contactless payments technology, & therefore they have a rather heavy following amongst people over age of 60’s.

This is a scenario for most customer over a certain age group. However, there are many other people, i.e. in the younger age group. For obvious reasons, that are less confident regards to CPT or Contactless Payments Technology. This is especially true regards to big payments or maybe payments crossing $75 or $100. Psychologically, it’s true that most people psychology wants to be confident with the type of technology that they are using. It’s their reliance & the trust that they have placed on the technology.

ATM MACHINES AS MOST RELIABLE CASH DISPENSERS:

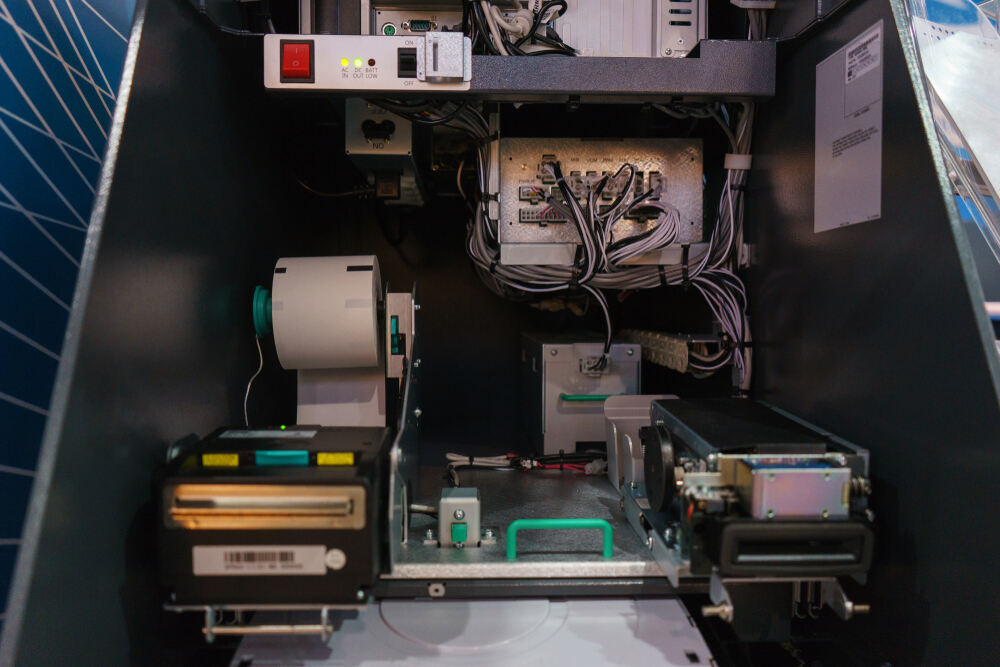

In the world of e-banking or electronic banking there are many transformations & variances that have taken place. This is apart from Contactless Payments Technology & ATM Machines. However, ATM Machines are still regarded as best & most reliable cash dispensers that we might come across.

Why & how? Taken as an alternative for an ATM machine, as basically, there is no other bank machine. Otherwise, an Automated Teller Machine. The cash-in machine is like a bank machine that accepts cash & shows that as available balance in your account. Something, which is a diversion for the ATM machine, but it has its limitations. It doesn’t dispenses cash as it accepts cash from the customers with the dedicated account.

ALSO READ: CONVENIENCE STORES & THE ATMs: ‘PRIORITY ATM MACHINES’

Atm machines, as reliable bank machines has most percentage, i.e. it might be not 100%. However, in most ATM locations its closer to 100%, i.e. 90 % or 95 % or in some places even 98%. Obviously, as ATM machines, sometimes are non-operational or the cash is not available. Finally, it is undergoing some kind of technical errors. Cardless Atm Transactions is a terminology that doesn’t exist, obviously, as there is nothing like this. As, you would definitely need a card for the sake of your ATM transactions. Checking the balance, if even you are interested in.

THE DEVELOPING WORLD VS THE DEVELOPED WORLD:

There are many things that makes ATM as preferable options as compared to CPT or contactless payments technology. However, it’s mostly the developing world which is still lagging behind regards to CPT. Alternatively, we might see a big change in next 10-15 years. Having said that, in the developed world which includes countries like Canada, UK, USA & Australia, things have switched slightly towards the CPT or Contactless payments technology.

A key reason is the level of trust people have on Contactless payments technology which is ironically more inclined in the developed world than as compared to the developing world. In the upcoming articles a comparison of the developed Vs developing world might make things clearer regards to the payments technology integrity.